Statistique entered the scene to create and implement a highly performing, totally automated trading platform when a U.S.-based financial services company aimed to get a foothold in the erratic crypto markets. Designed for speed, adaptability, and strong analytics, this solution has enabled our customer to execute trades with low latency—while preserving strict risk limits and complete market view.

Project Overview

- Client: Fast-growing crypto trading firm in the United States

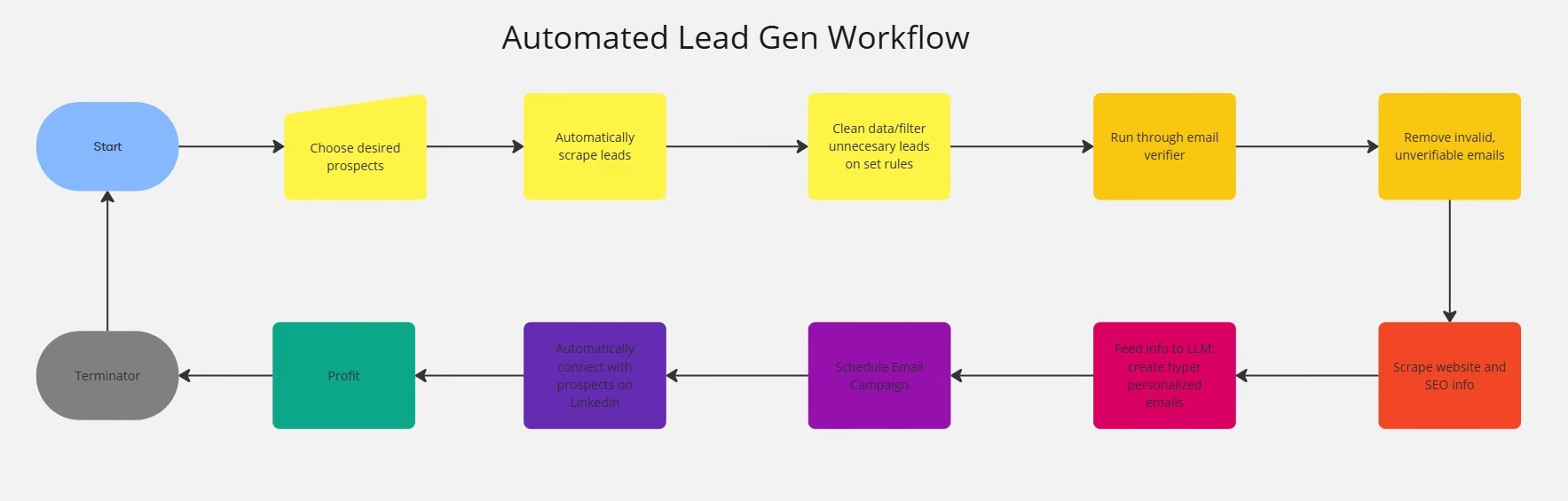

- Objective: Build a real-time algorithmic trading system that supports multiple cryptocurrency exchanges, backtesting, and strategy optimization

- Scope: End-to-end development—from strategy design and data analysis to deployment, monitoring, and user interaction via a custom dashboard, web interface, and Telegram

Key Components of the Solution

1. Rapid Data Ingestion & Analysis

To stay ahead of fast-moving crypto markets, we engineered a low-latency pipeline that continuously ingests market data from leading exchanges such as Binance, Bittrex, FTX, Gate.io, Huobi, Kraken, and OKX (formerly OKEX). Real-time price feeds, volume data, and order book updates inform the algorithmic logic and allow the system to react within milliseconds.

2. Backtesting & Strategy Development

A suite of backtesting and plotting tools was integral to our design. By analyzing historical trade data, we evaluated multiple strategies—ranging from simple moving-average crossovers to more advanced machine learning–based models. This rigorous testing helped our client identify profitable approaches and weed out underperforming tactics before risking capital in live markets.

3. Machine Learning Optimization

To enhance decision-making and adapt to evolving market conditions, we incorporated machine learning models for dynamic strategy optimization. The system:

- Predicts Market Movements: Forecasts short-term price fluctuations using time-series and regression methods.

- Adjusts Parameters in Real Time: Automatically updates thresholds for entry, exit, and risk management settings based on observed market volatility and performance metrics.

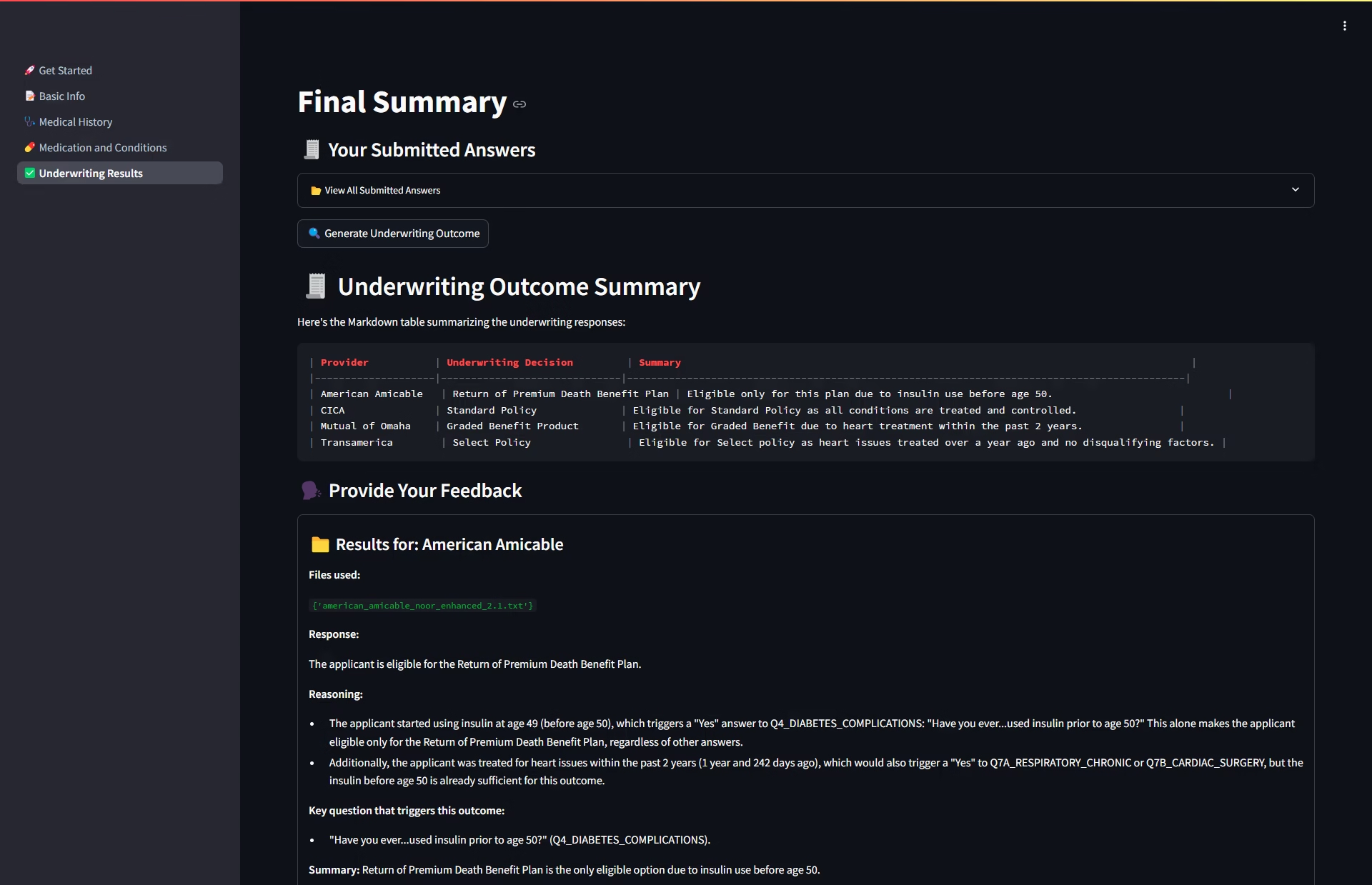

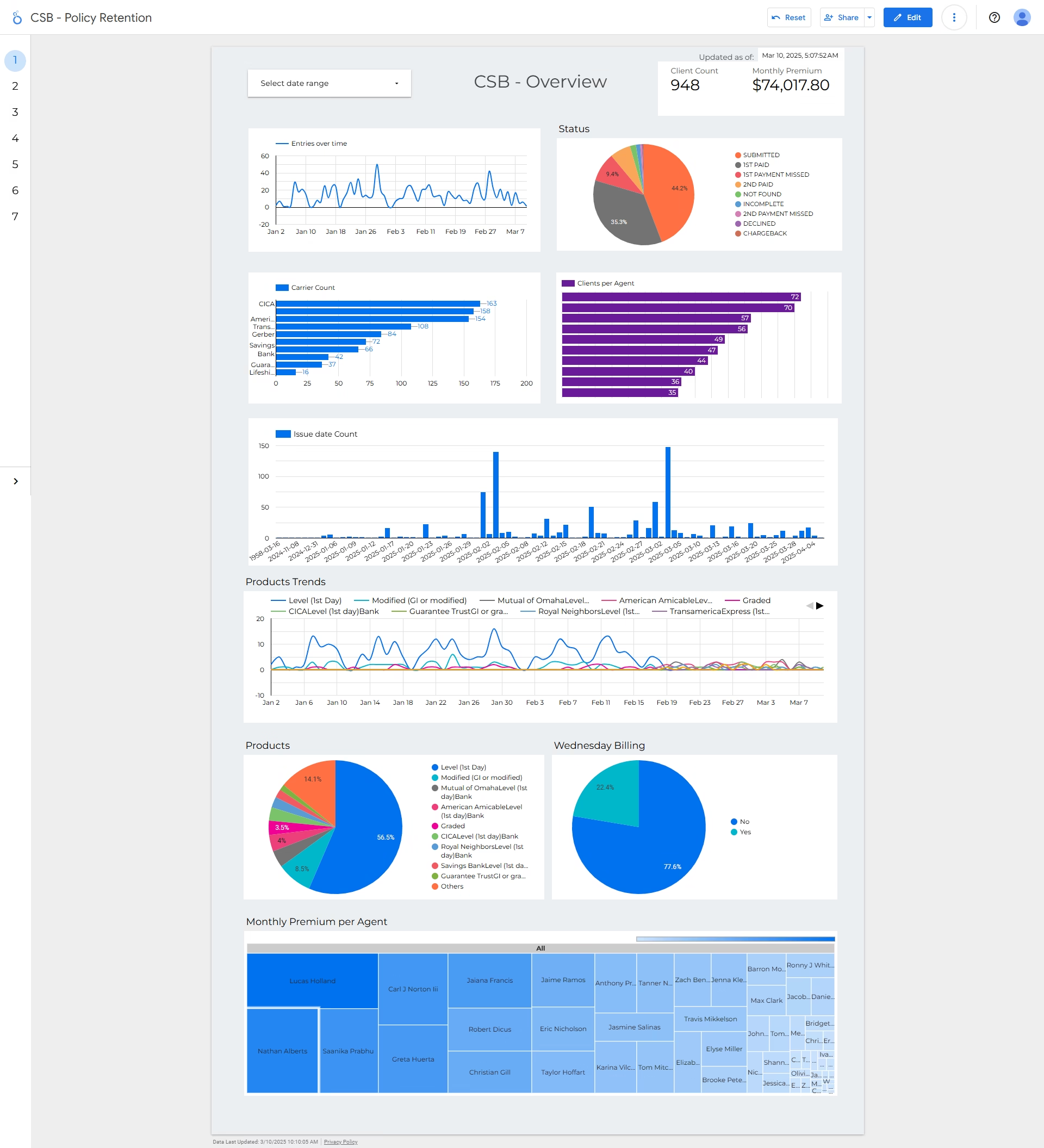

4. Real-Time Dashboard & User Interfaces

We developed an interactive dashboard displaying up-to-the-second trading activities, P/L metrics, and relevant financial indicators. The user interface, accessible both via web UI and Telegram, provides:

- Immediate Trade Execution: Manual overrides or additional instructions can be issued directly from the dashboard or messaging app.

- Comprehensive Portfolio View: Visualizes all open positions, pending orders, and performance history for quick decision-making.

- Notifications & Alerts: Automated signals are sent to designated channels whenever the system detects rapid market swings or hits user-defined thresholds.

5. Low-Latency Infrastructure

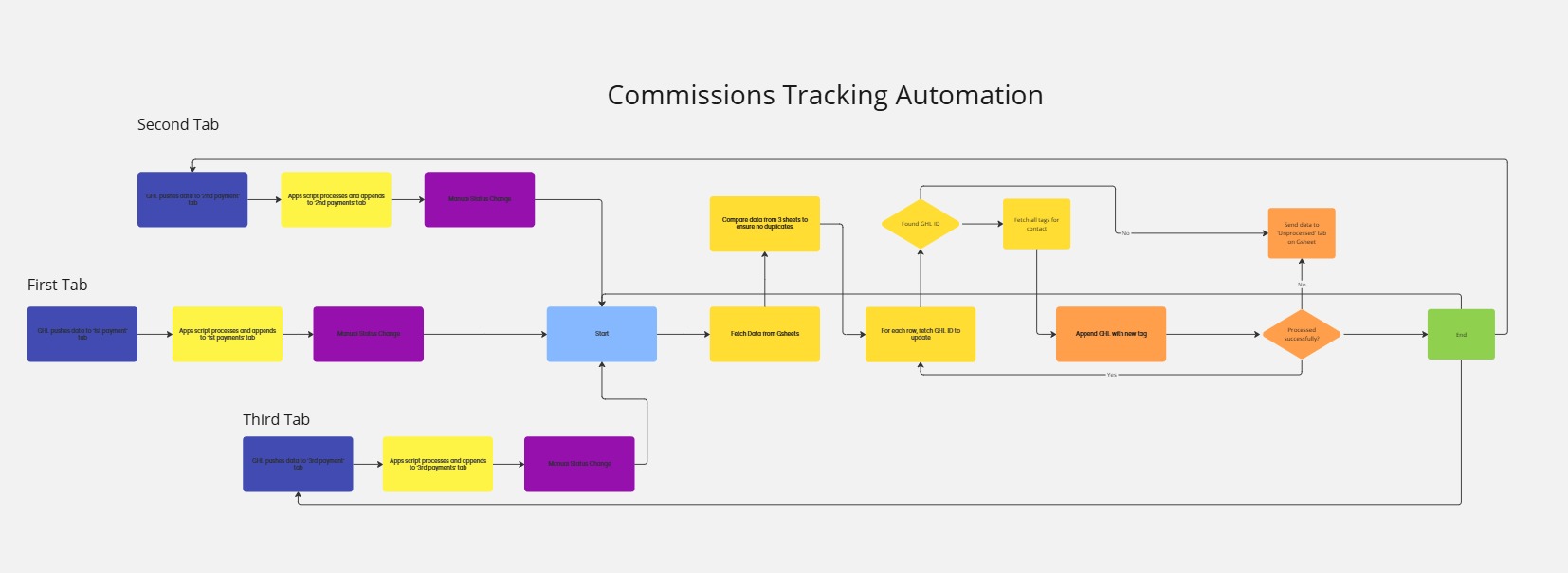

Built on a distributed, cloud-first framework, the trading engine processes high volumes of data around the clock. Key highlights include:

- Optimized API Calls: Minimizing latency when communicating with exchange order books.

- Scalable Architecture: Accommodates volume spikes without sacrificing performance.

- Continuous Monitoring: Watches over system health and automatically scales up resources when trading activity intensifies.

Business Outcomes

- Faster Entry and Exit

The client now capitalizes on split-second arbitrage opportunities and quickly exits losing trades before they erode profits. - Data-Driven Strategy Refinement

With integrated backtesting and live performance metrics, traders can pivot strategies in near real time—leading to improved profitability and reduced risk exposure. - Market Diversification

Supporting all major exchanges diversifies the firm’s trading environment, mitigating concentration risk and capturing more arbitrage windows. - Enhanced Operational Efficiency

Automated trade execution and consolidated dashboards free up staff to focus on strategic growth and complex analytics, rather than manual trade placement.

Why Statistique?

At Statistique, we mix hands-on subject expertise, advanced analytics, and machine learning to create tailored trading environments fit for your company objectives. Our agile approach guarantees quick implementation and continuous improvement; our user-oriented design gives complicated markets clarity and control.

All set to change your method of crypto trading? Get in touch to see how our customised solutions might provide you the competitive edge required to succeed in fast financial markets.